Calgary, Alberta Commercial Real Estate Appraisals

Commercial Real Estate Appraisal vs. Residential Real Estate Appraisal

What’s the Difference?

Property owners will find that commercial real estate appraisals in Calgary, Alberta differ greatly from residential real estate appraisals.

Property owners will find that commercial real estate appraisals in Calgary, Alberta differ greatly from residential real estate appraisals.

The difference between commercial real estate appraisals and residential real estate appraisal is primarily based on the income-producing potential of commercial properties. Commercial real estate appraisals require much more research and analysis than typical residential real estate appraisals. with three approaches to value typically considered including the cost, sales comparison, and income approaches.

Most commercial real estate appraisals require the appraiser to analyze the income-producing potential of the property, whereby leases, rent rolls, and income and expense information of the subject and comparable properties are considered.

Typically the commercial real estate appraisal report is developed in a full narrative format allowing the reader to understand the market conditions and dynamics in which the subject property competes, the quantity and quality of the available data, the analysis and interpretation of the data collected, the development of the relevant approaches to value, and the conclusions reached by the appraiser.

On this Page

Decide with data

Call 403.547.6434

Commercial Real Estate Appraisal Process

The appraisal process and required action steps are defined by our appraisal Standards (USPAP) regardless of the property type.

A real estate appraiser must identify the client and other intended users in order to properly define the problem and to understand the appraiser’s responsibilities in an assignment. This is accomplished by communication with the client at the time of the engagement.

A commercial real estate appraiser must not allow the intended use of an assignment or a client’s objectives to cause the assignment results to be biased.

The definition of the value to be developed in a commercial appraisal establishes specific conditions. These conditions impose parameters on the real estate appraisal assignment that are necessary to ensure that the results of the assignment are meaningful in the context of that definition of value.

Two dates are essential to a commercial real estate appraisal report. Standards Rules require that each commercial appraisal report state the effective date of the real estate appraisal and the date of the report. The date of the report indicates the perspective from which the commercial appraiser is examining the market. The effective date of the commercial appraisal establishes the context for the value opinion. Three categories of effective dates – retrospective, current, or prospective – may be used, according to the intended use of the commercial real estate appraisal assignment.

Characteristics would include its location and physical, legal, and economic characteristics; the real property interest to be valued; any personal property, trade fixtures, or intangible assets that are not real property but are included in the commercial real estate appraisal; any known easements, restrictions, encumbrances, leases, reservations, covenants, contracts, declarations, special assessments, ordinances, or other items of a similar nature; and whether the subject property is a fractional interest, physical segment, or partial holding.

EXTRAORDINARY ASSUMPTION: an assignment-specific assumption as of the effective date regarding uncertain information used in an analysis which, if found to be false, could alter the commercial appraiser’s opinions or conclusions.

HYPOTHETICAL CONDITION: a condition, directly related to a specific commercial real estate assignment, which is contrary to what is known by the commercial appraiser to exist on the effective date of the assignment results, but is used for the purpose of analysis.

A commercial appraiser must analyze the relevant legal, physical, and economic factors to the extent necessary to support the appraiser’s highest and best use conclusion(s).

When a sales comparison approach is necessary for credible commercial real estate appraisal assignment results, a commercial appraiser must analyze such comparable sales data as are available to indicate a value conclusion.

When a cost approach is necessary for credible commercial real estate appraisal assignment results, a commercial appraiser must:

i) develop an opinion of site value by an appropriate commercial appraisal method or technique;

(ii) analyze such comparable cost data as are available to estimate the cost new of the improvements (if any); and

(iii) analyze such comparable data as are available to estimate the difference between the cost new and the present worth of the improvements (depreciation).

When an income approach is necessary for credible commercial real estate appraisal assignment results, a commercial appraiser must:

(i) analyze such comparable rental data as are available and/or the potential earnings capacity of the property to estimate the gross income potential of the property;

(ii) analyze such comparable operating expense data as are available to estimate the operating expenses of the property;

(iii) analyze such comparable data as are available to estimate rates of capitalization and/or rates of discount;

(iv) base projections of future rent and/or income potential and expenses on reasonably clear and appropriate evidence; and

(v) weigh historical information and trends, current supply and demand factors affecting such trends, and anticipated events such as competition from developments under construction, when developing income and expense statements and cash flow projections

When the value opinion to be developed is market value, a commercial appraiser must, if such information is available to the commercial appraiser in the normal course of business:

(a) analyze all agreements of sale, options, and listings of the subject property current as of the effective date of the commercial real estate appraisal; and

(b) analyze all sales of the subject property that occurred within the three (3) years prior to the effective date of the commercial real estate appraisal.

In developing a real property appraisal, a commercial appraiser must:

(a) reconcile the quality and quantity of data available and analyzed within the approaches used; and

(b) reconcile the applicability and relevance of the approaches, methods and techniques used to arrive at the value conclusion(s).

In reporting the results of a real property commercial real estate appraisal, a commercial appraiser must communicate each analysis, opinion, and conclusion in a manner that is not misleading.

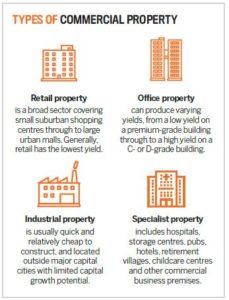

Property Types

Property Types

The subject of commercial real estate appraisal requests often falls within the industrial commercial investment (ICI) market segment. Property types can include, industrial, office, retail, multi-family and development land. On occasion, Institutional property valuations are requested for property types such as churches, schools and community association holdings which are not commonly traded on the open market.

Each subject property is unique and may require different approaches to value. Theoretically, all three approaches to value, the cost approach, the sales comparison approach and the income approach, can be utilized to develop indications of value. In practice, however, and depending on the property type and ownership structure, one or more approaches may be relevant, and variations of the income approach can be utilized.

Data for the development of the approaches to value can be collected from a variety of sources including MLS, commercial data research services, land tiles, CMHC and other governmental sources, interviews with property owners, property managers, commercial realtors, land use officials and networking with other commercial appraisers.

Depending on the property type market data research is conducted by commercial appraisers to develop market indicators which include the compilation of gross income multipliers, effective gross income multipliers, net operating income multipliers, price per square foot, price per room, price per unit, overall capitalization rates, and yield capitalization rates. These data enable the development of the approaches to value including the income approach and variations including discounted cash flow analysis.

Typically, the commercial real estate appraisal report is developed in a full narrative format allowing the reader to understand the market conditions and dynamics in which the subject property competes, the quantity and quality of the available data, the analysis and interpretation of the data collected, the development of the relevant approaches to value, and the conclusions reached by the commercial appraiser.

Land Valuation Methods

There are several methods of estimating land value. The commonly used methods are:

- Sales comparison

- Extraction

- Allocation

- Capitalization of ground rents

- Land Residual

- Subdivision Development

The most commonly used methods for valuing single-family residential land are:

- Sales comparison

- Extraction

- Allocation

| Appropriate Method | Assignment / Property Types | Data Available, Needed or Circumstance |

| SALES COMPARISON | Fee simple value All types of vacant land | Adequate comparable sales. |

| EXTRACTION | Improved sales in developed neighborhood or property group | Sales of homes with minimal depreciation available. New home sales available. |

| ALLOCATION | Statistical analysis of several sites | Available sales include relatively new improvements. Need to develop depreciated value of improvements. |

GROUND RENT | Commercial Properties | Need amount of contract rent. Need lease terms. Need rented comparables. |

| LAND RESIDUAL | Income producing properties | Identifiable Improvements value. Need net operating income. Need capitalization rates. |

SUBDIVISION | Sites in areas where vacant land sales are not available | Developed sites for sale are scarce. Market indicates an unsatisfied demand for lots |

Have Questions?

Call 403.547.6434

Commercial Real Estate Appraisals

Since 1999

1.403.547.6434 | Suite 239, 612-500 Country Hills Boulevard NE, Calgary, AB T3K 5K3

What Some of Our Clients Say

Other Appraisal Services

Agricultural Real Estate Appraisals

Inherited farming operation knowledge, an extensive proprietary comparable database, locally specific, and enlightened analysis generates highly credible results.

Residential Real Estate Appraisals

Timely, accurate, affordably high quality residential real estate valuations with the focus on efficiency have made Benchmark a leader for over twenty years.

Real Estate Appraisal Review

Peerless technical analysis of other’s work product, driven by strong appraisal credentials, review specific education, and strict compliance to Review Standards.

Benchmark Appraisals service region includes the cities of Calgary and Airdrie and several counties, towns, villages, and hamlets including, but not limited to:

Rocky View County | MD of Bighorn | Foothills County | Mountain View County | Kneehill County | Wheatland County

Vulcan County | MD of Willow Creek | Kananaskis Improvement District.

Cochrane | Strathmore | Turner Valley | Black Diamond | Okotoks | High River | Nanton | Vulcan | Stavely | Didsbury | Carstairs | Crossfield